This is the fifth and final part of our blog series in which we explored the David vs Goliath battle faced by the Australian creative industries, and what they might do to achieve success in the face of international competition.

In this section we attempt to apply the ‘new paradigm’ screen business models explored in Part 3 above, within the context of the Australian arts sector. We do this with a view to seeing how the business models explored above might fit with the needs of our sector, explored above in Part 4 of this series.

As a reminder, in above sections, we explored:

Part 1: We’re Tiny. The tiny size of Australian creative industries

Part 3: Business Models for the New Paradigm

Part 5: How a ‘new paradigm’ business model might help Australian artists

Taking the business model of the Online Original Content Channel (OOCC) from Part 3, we look now to see how this might look in the context of the Australian arts and cultural sector.

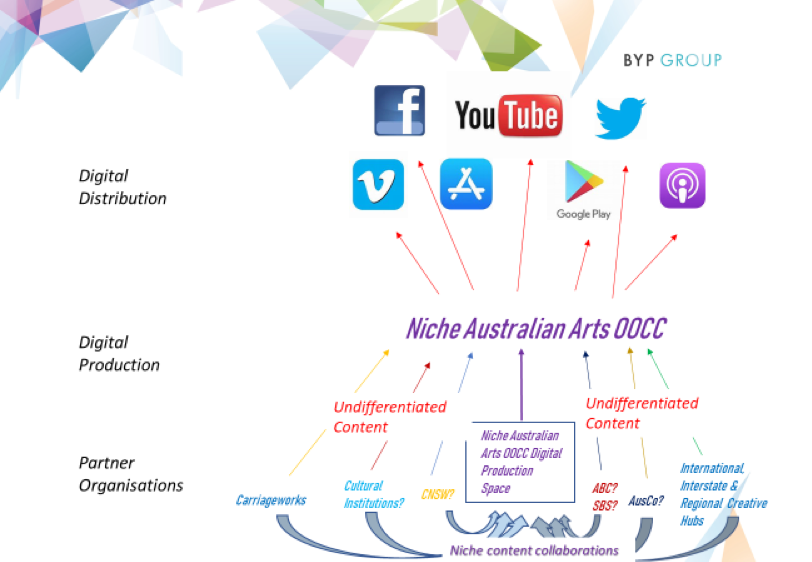

Diagram: Where an Online Original Content Channel for the arts would fit into the new paradigm ecosystem.

Above, we see the OOCC occupying the layer above the independent artists who now occupy the bottom layer in place of the YouTubers, or technically, alongside them.

The Australian Arts OOCC (purple lettering on the left) operates in a similar fashion to the OOCC entities we examined earlier – DanceOn and Geek & Sundry. On the one hand, in the diagram below, it operates as a ‘digital layer’ above the artists that aggregates content from independent artists who occupy ‘sub-channels/programs’ as we saw on DanceOn and Geek & Sundry in Part 3 of this series.

On the other hand, in the diagram below, it may additionally have a digital production capability including studio space, permanent crew/staffing etc. This would make it similar to the two OOCC’s we saw earlier.

Diagram: 1. Differentiated content model, like an OOCC. Artists and partners benefit from scale of digital production, output and distribution, so long as they collaborate to produce content within the NAOOCC's niche. Examples of niches that might be addressed include e.g. Indigenous Australian content, experimental and developmental content, multi-disciplinary,

Digital output does not equate to artistic output

Note, the digital output onto the NAAOOCC does not have to be the artistic outcome for any underlying creative hub facility, per se. Rather, the digital output is used in a way that suits the new paradigm – distribution and marketing of digital content (e.g. interviews with artists, retrospectives, podcasts, short ‘sizzle’ reels of music and/or dance). This raises awareness and interest, driving prospective audience/consumers to non-digitally replicable artwork e.g. live performances, digital media installations, exhibitions etc, that the artist can monetize on their own terms. It is envisioned that the artists collaborate with an on-site digital producer to determine the best type of digital content that will support the artist achieve sustainable practice in a manner suited to that artist.

Partnership Models

Partner organisations to the NAAOOCC could collaborate in one of three optimised ways:

Differentiated Content – This is the model in the earlier diagram ("Diagram: Differentiated content model, like an OOCC"). Where the content fits into the NAAOOCC’s niche, the content can be placed on the NAAOOCC’s own digital content aggregator channel e.g. ‘The Multi-disciplinary Art Channel’, ‘The Indigenous Australian Art Channel’, etc. If the niche content falls outside the NAAOOCC’s niche, this is an opportunity for a new, separate niche OOCC e.g. A disability arts channel.

Undifferentiated Content – Where the content produced is undifferentiated the optimization strategy tends towards the Multi-Channel Network (MCN) model described in Part 3 (e.g. similar to the Channel Frederator Network MCN). See diagram below.

Hybrid model - There is also potential for a third model, where the NAAOOCC has a service arm for partners and clients to create digital content more suited to the client e.g. a festival, a corporation, a funding body’s broader remit, etc. The revenues generated from this service facility help sustain an entity like the Niche Australian Arts OOCC, as well as providing alternative income streams for artists and creatives in the space.

Diagram above: 2. Undifferentiated Content model, similar to a the 'Multi-Channel Network' (MCN) example described in Part 3 of this series.

Diagram above: 3. Hybrid Content Model. The OOCC remains niche, but provides services to partners who may wish to create undifferentiated content e.g. advertising for their own organisation, policy need, etc.

Discussion for deciding between new paradigm business models – Niche OOCC vs Undifferentiated MCN

Strengths and weaknesses of the different models

Differentiated Content Model

Pro: Achieves ‘cut through’ in the crowded content ecosystem (See ‘Example: Importance of the niche strategy’ below)

Pro: Offers more aggregation benefits for content that falls within its niche

Pro: Suits funders addressing a niche area such as a policy gap area, e.g. diversity, experimental work

VERSUS

Con: Requires content made and aggregated to be in the same content niche, reducing the potential for partner collaboration

Con: Reduced size of aggregation benefits across some aggregation categories

2. Undifferentiated Content Model

Pro: Increased size of aggregation benefits across some aggregation categories

Pro: Allows more diverse collaboration partners

Pro: Suits funders with broad (undifferentiated) funding priorities

VERSUS

Con: Offers less ‘cut through’ in the crowded content ecosystem

Con: Offers fewer aggregation benefits for (undifferentiated) content on it

The above strengths and weaknesses are roughly indicative. For example, one may find that the overall benefits of ‘cut-through’ of an MCN exceed those of an OOCC even for differentiated content if the size of the MCN is large enough and efficient enough in passing on scale benefits.

Example: Importance of the niche strategy

As a quick (and by no means conclusive) demonstration of the importance of a niche strategy let’s look at the two OOCC’s we saw earlier in Part 3: DanceOn and Geek & Sundry. Both of these OOCC’s started around the same time and received the same funding from YouTube’s Original Content Initiative. To recap, ‘DanceOn’ is a channel that provides popular dance music and purports to find new ‘up-and-coming’ talent. Supported by the likes of Madonna and other high-profile music stars, it came with clear mass market appeal.

Diagram: OOCC’s with different levels of differentiation

The other OOCC is ‘Geek and Sundry’, which is very much about what it says it’s about – a collection of nerdy/geeky content. Suffice to say, Geek & Sundry is definitely occupying a narrower niche. How many people like popular dance music compared to … errr … Dungeons & Dragons? Obviously, a lot more people like popular dance music – otherwise it wouldn’t be ‘popular’. Here’s where it gets interesting ….

Diagram: DanceOn subscriber numbers (1.3M) vs Geek & Sundry subscribers (1.7M)

One might expect the OOCC with the more popular content to be way ahead: Both organisations were created as part of the now defunct YouTube Original Channel Initiative. This means both organisations are of similar age and had received the same resources - advanced payment of US$1 million by YouTube “against future advertising revenue to jumpstart production”.

Instead, the opposite is true (although again, not definitively so): DanceOn has 1.3M subscribers at the time of writing, compared to 1.7M subscribers for Geek & Sundry.

Why?

I speculate that what is happening is that, in the new media paradigm, it is not simply about size of demand, but also about the size of supply. Unlike broadcast media, the Internet is good at finding content to match more niche tastes. On the flipside, the Internet has an abundance of popular dance music content. Go to any online media splash page and you will find similar images to that of DanceOn. This may be what keeps subscriber levels below that of a true niche offering, like Geek & Sundry. Fans of things geeky have less choice for finding content providers of their niche tastes, consequently, the niche geek channel gets more subscribers than the pop dance video channel.

We speculate that areas of market failure in the cultural economy may represent opportunities for a niche OOCC should government choose to fund that gap. Market failure, for example in providing affordable experimental and developmental space for artists, represents a barrier to entry. Already in screen, we have seen two products with strong female lead casts get picked up overseas, namely Wentworth, and Mrs Fisher’s Murder Mysteries. With Screen Australia and other state agencies funding the gender gap, content can be made that fills an under-served market for strong female leads.